The Benefits of Hiring Experts in Construction Accounting for Your Business

The Benefits of Hiring Experts in Construction Accounting for Your Business

Blog Article

Understanding the Relevance of Building And Construction Audit for Successful Job Administration

Function of Construction Accountancy

Building and construction accounting acts as the foundation of monetary monitoring in the building sector, guaranteeing that projects are completed within budget plan and economic goals are fulfilled. construction accounting. This specific accounting strategy addresses the special difficulties dealt with in building tasks, consisting of differing job periods, fluctuating prices, and numerous stakeholders

One of the main duties of building bookkeeping is to supply precise expense evaluation and monitoring throughout the project lifecycle. This assists in informed decision-making, enabling job supervisors to readjust sources and timelines effectively. Furthermore, building and construction bookkeeping improves capital monitoring by checking accounts payable and receivable, hence making certain that funds are readily available for prompt payments to providers and subcontractors.

It furnishes project managers with the needed financial information to prepare comprehensive economic statements, which are necessary for audits and economic reviews. Inevitably, the role of building and construction accountancy extends beyond plain economic monitoring; it is essential to critical planning and functional efficiency, driving the success of building tasks in a competitive landscape.

Trick Parts of Building Bookkeeping

Budgeting develops a financial structure that overviews project implementation, allowing supervisors to allocate resources efficiently and expect possible financial obstacles. Precise price tracking is vital for monitoring expenditures in real-time, aiding to determine variances in between forecasted and actual costs. This enables timely changes to maintain the task on budget plan.

In addition, financial reporting supplies stakeholders with a clear photo of the job's financial wellness. Regular records, such as earnings and loss statements and capital evaluations, help with notified decision-making and enhance openness amongst all events included.

Furthermore, conformity with market regulations and accounting criteria is crucial. This makes certain that financial methods are not only efficient yet also lawful, securing the organization versus lawful effects. By integrating these vital components, building and construction bookkeeping cultivates a structured method to taking care of funds, eventually adding to the effective completion of building tasks.

Advantages for Project Managers

Leveraging reliable construction accounting practices gives job managers with a wide variety of advantages that improve both functional effectiveness and monetary oversight. One considerable advantage is enhanced budget plan administration. Precise tracking of incomes and expenses permits task supervisors to check economic efficiency in real time, guaranteeing projects continue to be within spending plan and helping with timely changes when needed.

Additionally, building accountancy improves cash circulation monitoring, enabling task managers to optimize and prepare for monetary needs source allowance. By comprehending cash inflows and discharges, they can much better manage repayments to providers, employees, and subcontractors, thus preventing pricey delays.

In addition, robust accountancy systems offer thorough reporting capacities. Project managers can produce records that provide understandings into task success, price variances, and resource usage. This data-driven approach promotes educated decision-making, allowing managers to determine possible concerns proactively and implement restorative measures.

Finally, adherence to building and construction accounting requirements guarantees conformity with lawful and governing requirements, reducing the danger of disputes or fines. Generally, efficient building and construction accountancy gears up job supervisors with the tools necessary to drive job success, improve stakeholder self-confidence, and advertise lasting organizational development.

Usual Obstacles in Building And Construction Bookkeeping

Lots of task supervisors run into considerable difficulties in building accountancy that can impede job success. Among the primary challenges is the intricacy of tracking numerous work sites, each with distinct budgets, timelines, and source appropriations. This requires meticulous attention to information, which can be frustrating without a durable audit system in position.

In addition, rising and fall product expenses and labor prices can complicate budget monitoring, making precise projecting challenging. Job managers commonly battle to resolve these expenses with Learn More Here actual expenses, bring about possible monetary discrepancies.

In addition, building accounting includes compliance with various regulations, consisting of tax obligation commitments and labor legislations. Navigating these policies can be daunting, specifically for supervisors who might not have a strong bookkeeping history.

One more substantial difficulty is handling cash circulation, which is vital in the construction sector. Hold-ups in invoicing, payments from clients, or unanticipated job modifications can develop capital shortages, threatening the job's progress.

Finally, reliable communication in between job supervisors, accountants, and field groups is crucial. Misconceptions can lead to imprecise financial reporting, better complicating job monitoring initiatives. Resolving these difficulties proactively is vital for successful building bookkeeping.

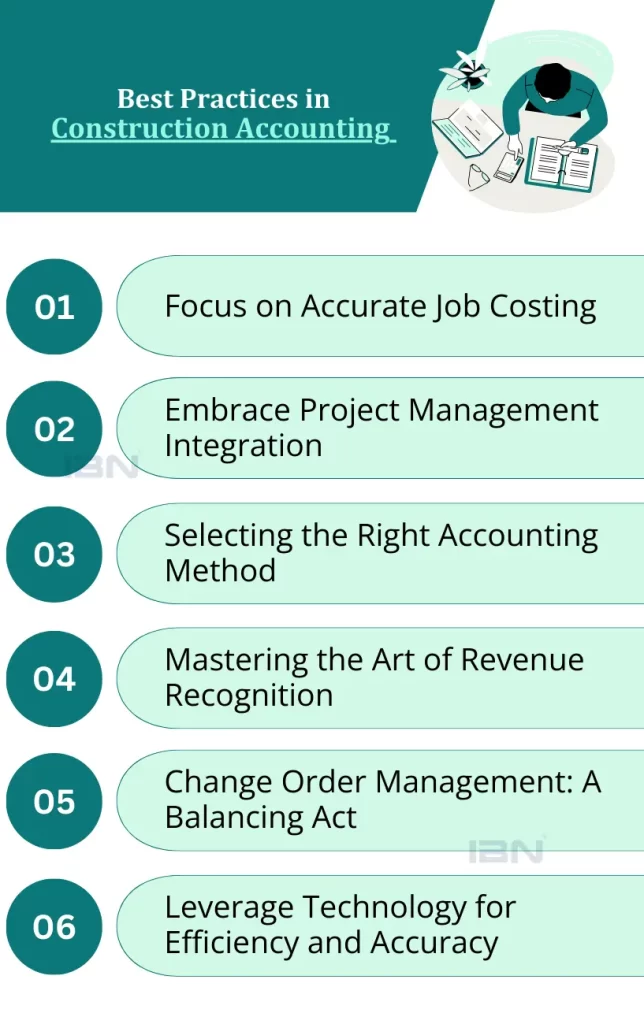

Ideal Practices for Effective Audit

While browsing the intricacies of building bookkeeping can be complicated, taking on ideal practices can dramatically boost economic monitoring and job success. One fundamental method is preserving precise and timely records. Executing robust accounting software program tailored to construction tasks can simplify information access, invoicing, and coverage, conserving and lowering mistakes time.

Furthermore, establishing a clear spending plan and normal surveillance versus this budget are crucial. Using a system of regular monetary evaluations allows job managers to recognize differences early, promoting timely decision-making. It is additionally necessary to separate job prices into indirect and direct categories, enabling more clear insights right into profitability.

An additional finest method involves cultivating open interaction amongst all stakeholders. Normal updates and joint conversations about financial status can ensure every person is lined up and informed. Educating staff in construction-specific audit concepts better improves expertise and accuracy.

Lastly, ensuring compliance with pertinent accounting requirements and policies is non-negotiable. Normal audits and internal evaluations add to openness and responsibility, building count on with customers and stakeholders. By concentrating on these finest practices, building firms can enhance their audit procedures, ultimately driving project success and monetary security.

Verdict

In final thought, building and construction accounting plays a critical function in making certain successful job administration by assisting in exact financial oversight and improving decision-making. By incorporating crucial parts such as price estimation, capital administration, and compliance, project managers can browse typical difficulties and take advantage of ideal techniques for effective accounting. Ultimately, a robust construction audit structure not just safeguards spending plan stability however likewise contributes to the overall financial wellness of building and construction tasks, cultivating lasting success within the sector.

By integrating these click to read more essential components, construction accountancy promotes a structured method to managing economic sources, eventually contributing to the successful conclusion of construction projects.

Exact monitoring of costs and revenues allows task supervisors to keep track of financial efficiency in genuine time, ensuring tasks stay within spending plan and assisting in timely check that changes when needed.

Project managers can generate records that provide understandings into job earnings, cost differences, and resource utilization.Many task managers run into significant challenges in construction accountancy that can hinder job success. construction accounting. Ultimately, a robust building and construction bookkeeping structure not only safeguards budget plan stability but likewise contributes to the overall monetary health of building tasks, promoting lasting success within the sector

Report this page